2019 fresh start tax program

Extended Installment Agreement August 12 2019 This program provides taxpayers a form of relief by entering into a repayment program that can. The Internal Revenue Service has a Voluntary Disclosure Program for individuals and businesses who have not filed their taxes.

Breathe Easy Really By Helping To Reduce Smoking To Build Better Health It S A Challenge Nkytribune

You can use the check to pay your school taxes.

. Help with IRS Tax Programs - IRS Fresh Start Experts. Ad End Your IRS Tax Problems. New OIC Applications The IRS reminds people facing a liability.

Ad Dont Face the IRS Alone. Many people wonder if the Fresh Start Initiative is still in place today in 2019. If you are registered for the STAR credit the Tax Department will send you a STAR check in the mail each year.

Claim for Brownfield Redevelopment Tax Credit - For Qualified Sites Accepted into the Brownfield Cleanup Program on or After June 23 2008 and Prior to July 1 2015 IT-6112 Fill-in IT-6112-I. 100 Online Over the Phone. Free Case Review Begin Online.

CPA Professional Review. Based On Circumstances You May Already Qualify For Tax Relief. Ad End Your IRS Tax Problems.

Now to help a greater number of taxpayers the IRS has expanded the program by adopting more flexible Offer-in-Compromise terms. They began rolling out the changes in 2011 and updated the programs in 2012 to ease the burden of. Get Free Competing Quotes For IRS Fresh Start Program.

The IRS Fresh Start Relief Program was designed to give taxpayers laden with first-time tax debt a second chance to do things right and it included. FRESH provides tax breaks for supermarket operators and developers seeking to build or renovate new retail space to be owned or leased by a full-line supermarket operator. Ad Affordable Reliable Services.

As explained above the Fresh Start program also allows taxpayers to avoid tax liens by setting the amount owed at 10000 before the IRS can file a Notice of Federal Tax Lien against them. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Free Consult 30 Second Quote.

Fresh Start Program. 100 Online Over the Phone. 100 Free Federal for Old Tax Returns.

Ad Prepare your 2019 state tax 1799. Fresh Start is not a program but rather a series of changes that the IRS has made to the tax. Take Advantage of Fresh Start Options.

The IRS created the Fresh Start program in 2009 after the recession. BBB Accredited A Rating - Free Consultation. Help with IRS Tax Programs - IRS Fresh Start Experts.

Fresh Start in 2011 to help struggling taxpayers. 5 Best Tax Relief Companies of 2022. Maximize Your Tax Refund.

Ad See If You Qualify For IRS Fresh Start Program. FRESH START INITIATIVE 2019. However taxpayers should file any delinquent 2018 return and their 2019 return on or before July 15 2020.

The IRS Fresh Start Program provides taxpayers with more flexible repayment terms and initiatives that may decrease or eliminate their tax debt without imposing penalties. While you can pay off your tax debt through full repayment to have your tax lien. This program has recently expanded to help more people struggling with tax bills.

A Tax Lien Withdrawal is technically considered a third tier of the Fresh Start Program. Dont Let the IRS Intimidate You. The IRS Fresh Start Relief Program was designed to give taxpayers laden with first-time tax debt a second chance to do things right and it included.

While there have been changes to IRS procedures after the Fresh Start Initiative. End Your Tax Nightmare Now. Ad Prevent Tax Liens From Being Imposed On You.

This helps the taxpayer reach an agreement with the IRS and allows the taxpayer to pay an amount. There are voluntary disclosure procedures and. Get A Free Consultation For IRS Fresh Start Program.

The Fresh Start Program mandates that the IRS cannot collect more than a taxpayer can pay. BBB Accredited A Rating - Free Consultation. Everything is included Prior Year filing IRS e-file and more.

Trusted A BBB Member.

Blog Truetax Tax Relief Representation Consultants

Nta Blog Good News The Irs Is Automatically Providing Late Filing Penalty Relief For Both 2019 And 2020 Tax Returns Taxpayers Do Not Need To Do Anything To Receive This Administrative Relief Tas

Irs Fresh Start Program Guide With 2021 Updates Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Tax Relief How To Get Rid Of Your Back Taxes Forbes Advisor

Irs Fresh Start Program Fortress Tax Relief

U S Energy Information Administration Eia Independent Statistics And Analysis

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

5 Things To Know About The Irs Fresh Start Program Before You Start The Process Geaux Tax Resolutions

Everything You Need To Know About The Irs Fresh Start Initiative 2019

What Is The Irs Fresh Start Program And Who Qualifies Explained The Us Sun

9 Qualifications For The Irs Fresh Start Program Tax Relief Center

What S The Irs Fresh Start Program

Everything You Need To Know About The Irs Fresh Start Initiative 2019

What Is The Irs Fresh Start Program How Does It Work

Irs Fresh Start Program Tax Help Tax Group Center

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

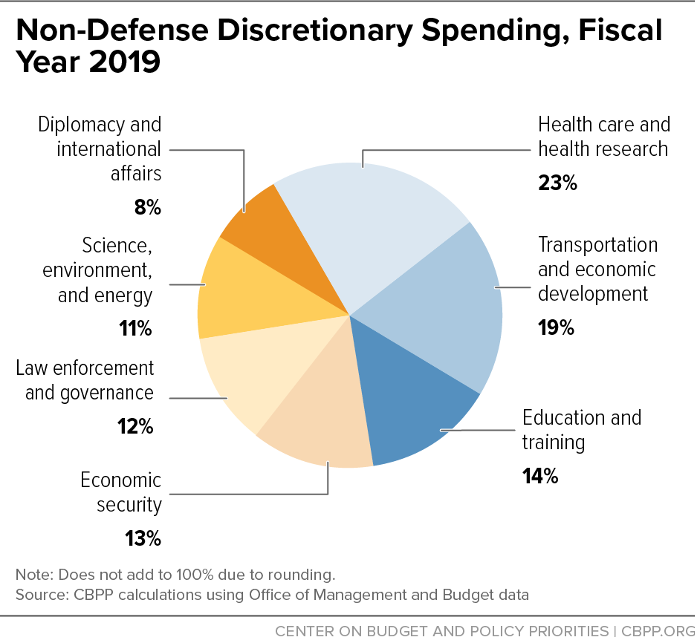

Policy Basics Non Defense Discretionary Programs Center On Budget And Policy Priorities

What Is The Irs Debt Forgiveness Program Tax Defense Network